This article will take a look at four of my favorite names in telecom. More specifically, it will look at which one of these stocks is the best investment at current price levels. Also, it will evaluate some of the opportunities on the horizon out of these names, with a case for the most compelling value in this industry.

The four stocks we will look at today are AT&T (T), Verizon (VZ), Vodafone (VOD), and CenturyLink (CTL). Please note that I wrote this article in 2013, but the dividend strength in these companies hold true today.

These stocks all pay a healthy dividend, and before we look at key metrics to help decide which stock offers the best opportunity for price and value at the moment, I would like to discuss the two stocks that I feel have had the most compelling developments over the past year.

Vodafone is in a great position right now with the news swirling that Verizon would like to buy out its 45% ownership interest in Verizon Wirless, their joint venture. It is possible that the deal could include a cash and stock offer, and the estimated dollar amount of this transaction is around $120 to $130 billion. This, in my opinion, makes Vodafone the most appealing stock out of these four right now if we are only looking at immediate value for spin-offs and corporate changes. As Vodafone is near a 52 week high currently, investors obviously are thrilled with these developments.

If Verizon were to make a cash and stock offer to Vodafone for this stake, it offers Vodafone some opportunities. The thing I worry about for Vodafone is if it is a mostly cash offer, the lucrative venture will no longer add to its earnings. In the event that it is mostly a cash offer, the company will have to be able to reinvest this money into a venture to grow its business, or look to acquire a company to add to earnings and possibly find a new source of growth. If I were Vodafone, I would consider making a move to acquire a large company if most of this deal was made in cash. I believe that a purchase of Directv (DTV), for example, could be a great fit.

To discuss the possible benefits of Vodafone exploring a buyout of Directv, let us look at a few things. Centurylink beat earnings estimates recently and reported great growth in its PrismTV cable subscription base. Based on this and based on seeing commercials and using PrismTV first hand, CenturyLink has done well venturing here. I believe, for Vodafone, that a purchase of Directv would be a great strategic fit. It would give the company the equivalent of what PrismTV is to CenturyLink, but on a much larger scale. I liken it to Altria's (MO) stake in SABMiller brewing company, as even though the companies are not in the exact same industry, they are a close fit. Altria has seen great results so far from its ownership stake in SABMiller. The benefits to such a merger include overlapping subscribers and bundling service, while also being able to reach out to a larger customer base. Directv is a $36.71 billion company based on its current market cap, while Vodafone currently has a $147.49 billion market cap. I would view such an acquisition as being a bold move, and a move the company should only consider if it wants to take an aggressive move toward growth. A large cash infusion from its stake in Verizon Wireless could certainly make it more feasible from a cash standpoint. Furthermore, the antitrust obstacles that AT&T encountered with its proposed acquisition of TMobile may not come into play if Vodafone tried to acquire Directv and if Directv is successful in its bid to acquire Sprint (S). Vodafone's primary telephone market is in Europe and if it no longer is involved in Verizon Wireless, this could provide it with an entry to the U.S. market and add further value to the company.

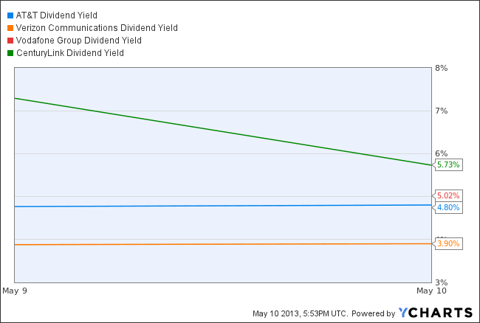

Furthermore, I would like to look at some metrics to evaluate when deciding where I would put new money at this point with these companies. I am already long all four companies, but if I were to put new money in right now, I would be selective as to where. Dividends are a compelling factor for me as far as this industry goes, so let's take a look at where these stand.

T Dividend Yield data by YCharts

CenturyLink has the highest current dividend yield. CenturyLink, however, cut its dividend earlier this year. I believe the market reaction to that was way overdone, as did many other people, as it sank by over 20% the day that was announced. Since then, the price has recovered. I believe it was overdone especially because the company planned to buy back stock and pay down debt instead of maintaining the previous dividend, which is value added to the company. The other stocks above have solid dividends, with long histories of increases. The recent stock price increases that the companies have experienced have lowered the yields, and a couple of years ago I would have wanted a 6% dividend yield. Now, 5% is the best we can hope for while the long-term bonds of these companies can net you a slightly higher yield.

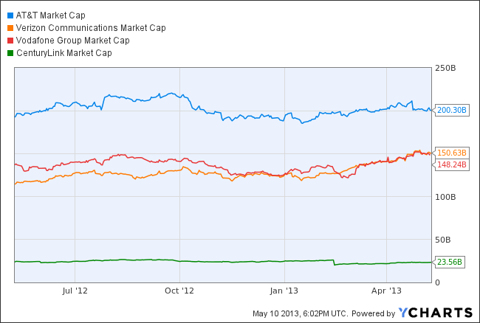

The following chart will look at the market cap for each company.

T Market Cap data by YCharts

AT&T has the highest market capitalization of this group. Verizon and Vodafone are a close second and third, with CenturyLink far behind. I think market cap is important because it can help a company withstand a prolonged downturn, as evidenced by the companies getting through the financial crisis in 2008 without having to cut their dividends.

Based on these factors and qualitative considerations, I have the following opinions on these stocks. AT&T and Verizon are solid companies with a long history of dividend increases and value added spin-offs for shareholders. In the near term, I do not see anything out of the ordinary coming from these companies. With CenturyLink, its acquisition of Savvis and its PrismTV are two exciting developments and growth opportunities. I view PrismTV as something that could be spun off in the future, but I think that will take many years to materialize into something worth a few billion dollars. In the near term for new money, I would say that Vodafone is the way to go. It pays a strong dividend and there is the possibility that shareholders could get shares of Verizon if a buyout of Verizon Wireless comes through. The exciting potential that Vodafone has from its potential divestiture in Verizon Wireless motivates me to add to my position here if I were going to do anything. I hold all of these stocks in my portfolio and think that they are all great long-term investments. Please conduct your own research and due diligence before deciding to invest in any of these stocks.

No comments:

Post a Comment