Rio Tinto shares are currently down a modest .41% or so on the ASX. Shares are lower despite being seemingly way undervalued. Its dividend yield can certainly be seen as progressive and appealing here.

Undervalued crypto picks for 2022 and 2023 are picked here with great crypto faucets and ways to earn free Dogecoin Bitcoin Litecoin Tron Shiba and more. I currently have invested in Nimiq Dogecoin Bitcoin Tron Litecoin Digibyte and many more cryptocurrencies. @HODLdogecoin is the site Twitter and YouTube handle as well. Please visit us on these platforms as well.

Earn with IDUSA for Identity Theft Protection

Tuesday, September 30, 2014

Rio Tinto Lower This morning on the ASX

Coca Cola Amatil Powers Higher

Coca Cola Amatil is having an up day today on the ASX. At the current time, shares are trading higher by .51%. It is finally on the third day of the week that shares are in the green.

Monday, September 29, 2014

Will Rio Tinto Mine for Gold?

Currently for Rio Tinto, gold is an afterthought at best. The majority of sales/are from iron ore. If Rio did want to compete in the gold market, its economies of scale would give it instant credibility and competitive edge.

Global Currencies Forex Market

The market trading volume of foreign global currencies, aka forex, trumps that of other investment markets including the stock exchanges. This allows investors a chance for high powered trades with constant action.

Is Gold Undervalued?

Gold is well off of its all time highs. Is gold bullion a good investment? It is a hedge against the U..S. Dollar and it is also fun to invest in.

China Worries Easing Today for Rio Tinto

Worries of a slowdown in China are easing today, as far as Rio Tinto's share price is concerned. The stock is trading up on the ASX despite the fact that Wall Street had another down day yesterday.

Diplomat Pharmacy IPO

On 10/10/2014, Diplomat Pharmacy is scheduled for its IPO at $14-$16 per share. This is quite a reasonable price range.

HubSpot IPO

The HubSpot IPO is scheduled for on or around 10/92014 and its expected price range is around $19 to $21. Its ticker symbol will be HUBS. I have no opinion for a price target or recommendation.

Rio Tinto and Coca Cola Amatil Mixed Today

Today on the ASX, Rio Tinto is currently up by about .25% while Coca Cola Amatil shares are/sharply lower by 1.19%. This mixed performance has made it a tough first days of the week for these two stocks.

Alibaba Third Quarter Earnings

Alibaba's first earnings report as a public company will be its third quarter earnings for this fiscal year. This report will come under heavy analysis and scrutinization. We will be watching to see if Alibaba can exceed analyst estimates.

Defensive Stocks Outperforming Today

Defensive names such as Vodafone, Altria, Reynolds American, and Lorillard are actually up today while the rest of the market is suffering from a current 83 point drop in the Dow. Investors can always flock to the safety of dividends.

Bank of China Pares Losses

Bank of China is now down 1.4%. This is an improvement from the 2+% decline we saw earlier today. If we can get some big days this week on the Hang Sent Index, we could still see substantial gains this year.

FMSA Holdings IPO

The IPO for FMSA Holdings is based on an expected pricing range of $21 to $24 per share. At this level, the offering is worth in excess of $1 billion based on the information from NASDAQ. This is definitely a huge IPO.

Sunday, September 28, 2014

JP Energy Partners Upcoming IPO

JP Energy Partners, LP has its IPO of stock scheduled for October 2, 2014. The expected price range is $19.00-$21.00 per share per the NASDAQ web site. With energy being a sector with a lot of momentum, this could be a good IPO to watch.

Rio Tinto is Now Down 1.16%

As the day has progressed in Australia, Rio Tinto plc shares are now trading down by about 1.16%. Weakness has continued from the beginning of the ASX trading day.

Gold is at 1221.50 Up by .28%

Gold,as one of the top commodities, is in the green today, up .28%. Investors looking to add diversification to stocks and real estate should look into buying gold. It is an undervalued pick here because I feel with any rise in interest rates, it could resume a climb.

US Dollar is Strengthening This Morning

The greenback from the United States is stronger today. Investors in the dollar apparently like the fact that the US is poised to increase interest rates in the foreseeable future according to comments by Janet Yellen.

Bank of China is Lower This Morning

Bank of China is trading lower by about 2% this morning. It is a lot of weakness here, hopefully the rest of the week is kinder to bachy.

Alibaba Trading in Stuttgart

Alibaba trades in Stuttgart and its most recent trade on September 26th saw it close higher at 70.91 per share. It I'll be interesting to see the currency fluctuations impact as time progresses with the share price. Its ticker symbol there is ahla.sg

China Mobile Down Slightly - Hang Seng Index

So far this morning in Hong Kong, China Mobile is trading lower by about .11%. This is a small drop and it still seems to be bucking the downward trend in Asia this morning.

Rio Tinto and Coca Cola Amatil Down on Monday Morning - ASX

On the Australian ASX this morning, shares of both Rio Tinto and Coca Cola Amatil are trading lower. Rio Tinto is off by about .75%. Modest declines/so far, we will see how the day progresses.

U.S.A. Stock Futures Down Monday Morning

Early Monday morning, the djia stock futures are currently down about 48 points. After Friday'sbroad based gains, investors may be looking for direction in the coming week. We are at a pivitol point for direction and volatility.

Would Warren Buffett Buy Microsoft Shares?

Warren Buffett is not usually interested in technology stocks. With Microsoft, however, it is a steady blue chip company and it pays a high dividend yield in relation to other tech stocks. It also has had a great one year performance with the dividend expected to grow briskly in the near term. This may be a stock that Buffett would consider based on this value. MSFT for BRK-A's portfolio? We will see.

McEwen Mining MUX - Undervalued Potential

I think McEwen Mining, ticker symbol MUX is a great stock. I am long in it. It has mineral rights interests in various locations including in Nevada. We all know that Reno and Las Vegas are home to big time gambling,and I would say that buying this stock has similar risk because it is not yet profitable. However, it has been highlighted as a top pick by well known sites such as 24/7 Wall Street I believe, and I would take a modest roll of the dice on it with the potential to strike it rich with a 10 bagger if its plans work. That's a significant if.

Saturday, September 27, 2014

Hedging International Stocks With High Leverage Forex Currency Trades

If you are a US investor and want to buy stocks such as China Mobile, Alibaba, Rio Tinto, America Mobil, or any other major ADR, you can buy the shares in foreign currency through many brokers such as e trade. By doing this, you have access to also investing in the currency from that country. You can potentially enhance that investment by a high leverage forex options hedge on the currency. Links on this site can help you with that.

MKM Research Slaps $125 Price Target on Alibaba

http://www.marketwatch.com/story/alibaba-shares-could-nearly-double-ipo-price-in-a-year-mkm-2014-09-22

Alibaba had a price target established for it by MKM Research of $125 per share within a year. Please see the link above for that story. I think it is $5 too high, my target is $120 and I find that to possibly be understated. I would rather be pleasantly surprised than set the bar too high. If it goesmto even $120, current investors will make some serious cash in a year or less.

Alibaba had a price target established for it by MKM Research of $125 per share within a year. Please see the link above for that story. I think it is $5 too high, my target is $120 and I find that to possibly be understated. I would rather be pleasantly surprised than set the bar too high. If it goesmto even $120, current investors will make some serious cash in a year or less.

Alibaba Intermediate Term Price Target

For purposes of Alibaba stock, I am going to call intermediate term six months. I am setting a $110 price target within six months,to add to the $120 price target within 12 months. Time will tell, but I think the company has unheard of gross margins and will present whopping growth in the coming quarters.

Altria is Kicking Butt

Altria is kicking butts, pun intended. The cigarette maker is hovering around a 52 week and all time high, and with news swirling that SABMiller will be acquired, shares look to still be a cannot miss value. That is, because Altria owns approximately 27% of the brewer. Disclosure - long MO

Alibaba is in Good Position

With a $90.46 per share closing price on 9/26, the future for next week for Alibaba looks bright. With the all time high of over $99 per share, I reiterate my price target of $120 per share and believe it will get there within a year if not sooner.

Friday, September 26, 2014

Vantage IPo Interest

The interest level is high for the Vantage Energy iPod. From my own research, I feel it has a good chance to trade higher on day one. Internet searches for it are brisk.

Petrobras and Itau Trade Higher

Shares of pbr and itub are both trading sharply higher today. This is welcome news because over the last two weeks shares have struggled. With the election looming, a win by Marina Silva would provide a boost to these stocks.

Thursday, September 25, 2014

Stock Woes Continue Today

Today the stock market is down a lot from global concerns. The Dow is currently off by 264 points. Stay tuned to see how the day progresses. I see a late day rebound coming.

Wednesday, September 24, 2014

Vodafone Shares Gain Nicely Today

I think Vodafone is undervalued here. I like Vodafone and am long in shares. It went up over 2.5% today and outperformed the general market. When the eventual European recovery occurs, I believe Vodafone will move sharply higher.

Trading Options and Currency

If you open a new account here at some of Tue offers, you can get bonus cash on your initial deposit. Trade currencies and stock options to maximize your return on investment. Also, there are free webinars here to help you learn more about trading.

First Alibaba Quarterly Earnings Report as a Public Company

The first quarter of Alibaba as a public company will report earnings soon enough. This will be an important measure of profitability in addition to insight into the future. With lofty expectations built in, any earnings miss could be detrimental to the stock price.

Alibaba Stock May Have Found a Bottom

With yesterday introducing Alibaba to a new 52 week low of $86.62 or so per share, we saw a strong bounce back today. Of course, technical indicators are limited right now due to the short trading history of baba. I feel that there is a decent probability though that we have found at least a short term bottom and could rise nicely from here.

Best Practices for Equity Research

Learn from the pros. Find ways to research stocks like analysts do. In this awesome book by James Valentine, learn the secrets that can make you the dollars by making smart buys. With your investment strategy, you may find shares you feel are undervalued. Find the book here.

Investing in Gold and Bullion

This site has partnered with top names in the gold and silver and bullion market to help you invest in precious metals. Find the information here to see how much you can make by investing in gold and silver.

Will Warren Buffett Buy Airline Stocks?

I wonder if Warren Buffett will start buying airline stocks. The profits in them are growing and very strong, and with oil prices currently reasonable, there is no immediate threat of oil prices interfering with profits. An investment by Warren Buffett into Southwest Airlines or Delta could propel the stocks even further immediately since investors tend to jump in to his investments. Rightfully so.

Vale Up Today Over 2%

Shares and f Vale rose today by over 2%. This is important because shares are now up for two consecutive days. This adds some momentum to a stock that I love here and I think we may be starting to see a long awaited up trend.

Stocks Rise Today - Alibaba Up 3%

Wall Street roared back today and Alibaba shares rose back above $90 per share. There were many areas of strength with the Dow spiking 156 points.

Alibaba Dips to $87.17 Per Share

I believe that this dip in Alibaba's stock price is due to the general market from the past two days. After hours, the stock did march higher though up to around $89 per share. Futures point to a higher open for the tech heavy NASDAQ so we could see gains in baba later today.

Dow Futures Pointing Higher

This morning, Dow Jones futures indicate a higher open as they are up about 20 points, with the NASDAQ and s&p 500 futures also in the green. A bounce back from two rough trading days would put the bulls at ease.

Tuesday, September 23, 2014

Airline Stocks Still Are Undervalued

First off, if you look at a 10 year history of share prices for Delta, Southwest Airlines and others, you will see that prices declined and stagnatedmfor these shares for quite some time. The shares finally bounced back a couple of years ago with staggering returns, but if you annualize those returns over the last 10 years, you will see that the results are more modest. Add to this the fact that these companies are recently generating huge profits, and you can possibly draw the conclusion that I have. That is, that they can run much further.

Does Warren Buffett Think Alibaba is Undervalued?

What would Warren Buffett think about Alibaba's share price? With high gross margins and expected future growth, I cannot help but think that the miracle of Omaha has been scoping out the stock. While technology is not his favorite industry, I believe that this stock could potentially be on his radar.

Will Warren Buffet Sell His Stake in Bank of America?

Warren Buffett bought his shares of Bank of America during the depths of the financial crisis. Since then, that buy price has been proven to be significantly undervalued. As it stands, he is sitting on a nice unrealized gain. Is it time for Buffett to sell all or some of boa shares? What do you think? I say lock in those profits.

Rio Tinto is Trading Higher This Morning

In early morning trade, Rio Tinto is trading higher on the ASX Australian stock market. This is likely much to do with the fact that yesterday it went up on the NYSE.

Will Warren Buffett Buy Rio Tinto Shares?

Warren Buffett would be wise to consider adding shares of Rio Tinto to his Berkshire Hathaway portfolio. Rio Tinto represents deep value and is currently unloved by the stock market.

Rio Tinto Shines in Down Market Day

Shares of Rio Tinto bucked Tue downward market trend today, ticking up by about 1.5%. With its high dividend yield, it is very undervalued at current price levels in my opinion.

Dow Futures are Down and Undervalued

Dow Jones futures are down this morning and I find them to be undervalued after yesterday's large drop. I view this as an excellent entry point for buying opportunities. I still favor large cap stocks over small caps.

Alibaba Could Follow Facebook

Shares of Alibaba could follow Facebook in that they could drop post IPO for awhile and then bounce back strong to new all time highs. Look for market action in baba tomorrow.

Alibaba Stock Price Drop

Yesterday, shares of Alibaba dropped and the dip continued after hours. Shares of Yahoo! followed suit. I believe that long term, investors in Alibaba will be fine with significant gains on the horizon.

Monday, September 22, 2014

Upcoming Ipos

There are some great IPOs coming up this month and next month. IPOs are a great way to find undervalued stocks that can trade higher starting on their first day.

Stocks Tumble Today on Wall Street

With some calling the stock! market a bubble right now, stocks tumbled today. Breadth has deteriorated lately, and worries won out today.

Saturday, September 20, 2014

Eyegate Pharmaceuticals IPO October 3, 2014

Eyegate Pharmacy will have its IPO on October 3rd. There is no pricing information for it yet. I expect for this to be a relatively low profile IPO after the bonanza of Alibaba this month.

Can Alibaba Stock Rival Baidu?

When Baidu stock went public, it went up over 200% on the first trading day. Alibaba went up significantly on Friday, but nowhere near that much. Over time, I expect there to be further gains due to high profitability and growth. What do you think? Please feel free to provide your commentary.

Vantage Energy IPO

The Vantage Energy IPO is coming up on September 25th. The expected price range for this listing is $24-$27 per share. I think the energy sector is a good place to look for gains in IPOs currently.

Upcoming Stock Market Week

This week coming up for the stock market will be crucial. If we are going to close 2014 strong and have a Santa Claus rally, an upswing headed to the end of the year could provide investors with significant gains. The direction of the fed will be closely watched.

Alibaba Closes at 93.89 on Opening Trading Day

On Wall Street, Alibaba closed its first day of trading with a staggering gain, and finished with a closing price of $93.89. Investors cheered the debut, and rightfully so as the company is extremely profitable.

Friday, September 19, 2014

Alibaba Steady With Shares Near $90

Price action for Alibaba has been amazing, with shares right now at about $90. The open was $92 and the high of the day was over $99 per day. There are more gains coming I would think.

iPhon6 Launch and Alibaba Trading

What news story is bigger? The IPO of Alibaba with trading beginning today on the NYSE or Apple's launch of the iphone6? No matter what, this is going to be a bonanza of a holiday season for the stock market.

Institutional Investors and Mutual Fund Ownership in Alibaba

Who do you think will own the most shares of Alibaba out of major mutual funds and institutional owners? Black Rock wanted in and I think that someone is going to step up and take 10% ownership. That could be a hedge fund as well. Fidelity funds or Merrill Lynch might want to own many shares as well.

Dow Jones Futures Up 70 Points

Currently the Dow Jones Industrials are up about 70 points leading up to the opening bell. With Alibaba debuting today, this is poised to be a special day for the stock markets worldwide. Adding to this is the good news regarding Scotland.

Alibaba Shares Post IPO Begins Soon

In less than 4 hours, Alibaba stock will begin trading on the open market. I think the stock could go to $90 today. We will see but I am sure baba will be a focal point of the opening bell.

Thursday, September 18, 2014

China Mobile Shares Trading Sharply Higher

This morning on the Hang Sent Index, China Mobile shares are currently sharply higher by about 1.85%. This move could be tied to the upcoming debut of Alibaba later this morning. China Mobile is a waiting the release of the iphone6 by Apple.

Alibaba is Lifting Global Markets

Is there anything that Alibaba can't do? Right now, it is increasing prices of global markets. Shares such as China Mobile are in an upswing currently.

Alibaba IPO Oversubscribed - High Demand

The high demand for Alibaba shares today at $68 per share has caused many investors who tried to get shares in the IPO to come up empty handed. With only so many shares out there, many would be investors will have to wait for tomorrows opening bell.

Royal Bank of Scotland Stock

The Royal Bank of Scotland has a US ADR that trades its shares at about $11.75 per share. I have yet to form an opinion as to whether or not this is a good buy.

Scotland Stocks

Do any of you know stocks of companies based in Scotland? I do not know any off hand and would value reader input on public companies that are based in Scotland.

Will Carl Icahn Buy Shares of Alibaba?

Carl Icahn could easily take a large stake in baba now that shares hit the market tomorrow. Icahn may like this investment, just like when he made a ton of money with Netflix. He may be more likely than Warren Buffet to buy shares because these shares of Alibaba may be exactly what he is looking for.

Matt Nesto on Alibaba

It will be interesting to see what Matt Nesto has to say about Alibaba. The former CNBC analyst will surely have some sort of opinion on the stock, possibly including whether or not shares are a good buy.

Will Warren Buffett Buy Shares of Alibaba?

This is a big question. If Warren Buffett would consider an investment in China, shares of Alibaba may be the ones to purchase. With high gross margins and growth, Alibaba has what it takes to attract investors like Buffett.

Alibaba Depends on Chinese Consumers

Alibaba is dependent on the Chinese consumer if share prices are to increase. That being said, the company dominates ecommerce in China. It is a stock that will be highly watched tomorrow. What do you think it will open at? $85?

Alibaba Commentary - What Are Your Thoughts on the IPO?

I want to know what the readers think. What are your thoughts on the Alibaba IPO on sept 19? Do you think the stock will go up or down? What are the company's strengths and weaknesses?

Alibaba Countdown to Market Open

It is less than 15 hoursmaway - Alibaba shares will soon open for trading in New York. Investors are lining up to buy shares. What are your thoughts on the baba IPO?

Southwest Shows Shareholders the Money

Shares of Southwest Airlines have soared to over $35 per share and I believe that they could easily go tom$40 soon. The company is reaping profits with good fuel costs and value added services for passengers that are heading straight to the bottom line.

Alibaba Shares Do Not Need Traditional Lock Up Period

Usually, IPO issues have lock up periods. This is to protect the initial value from insiders selling shares early. In Alibaba's case, they do not need it because I expect opening trading volume to be a bonanza.

Why Would You Not Buy Alibaba Stock?

I have seen some headlines telling people to not buy Alibaba stock. I think that this notion is absurd. Alibaba is the next Amazon, and I believe that investors getting in now will be richly rewarded. With founder Jack Ma at the helm, you cannot go wrong.

Google Stock is Undervalued Price Target $700

In my opinion, shares of Google are undervalued. My 12 month price target for Google shares is $700 per share based on advertising sales strength and its leadership position in online search.

Amazon is Undervalued - Price Target $450 Per Share

In my opinion, Amazon is way undervalued. I am setting a 12 month price target of $450 per share. This is based on core customer strength and rapid business expansion which will lead to increased profitability.

Alibaba IPO Price

Even if people subscribe to the baba IPO at the high end of $68 per share, I fully expect that the share price after trading begins to rise to over $100 per share. This is in line with many analyst price targets and opinions.

Market Capitalization of Alibaba

Some had estimated that the market capitalization of Alibaba was going to exceed $100 billion. I agree with this view. When trading starts tomorrow,I expect a quick share price rise.

Alibaba IPO Moved Up - Trading Begins on September 18th

ThenAlibaba IPO has been moved up to start today, on September 18th. The stock will begin trading today and wall street is buzzing with the most highly anticipated debut for shares in a long time.

Alibaba on September 18th

Alibaba is getting ready for its market debut on September 19th. On the day before, then18th, watch for more headlines about Tue stock. I expect more analysts to come out with price targets and opinions soon.

Wednesday, September 17, 2014

China Mobile Shares Sharply Lower in Overnight Trading

In Asia, shares of China Mobile are currently sharply lower by 1.62%. This does not bode well for the US market open of shares later today here in the US.

China Mobile and Bank of China Trade Lower

China Mobile and Bank of China sharesmare drifting lower in early morning trading today. I expect further direction to be implied with trading on the NYSE tomorrow morning. In my opinion, these are two great undervalued stock picks.

Shares of Vale are Lower Today

Shares of iron ore giant Vale are lower in today's trading by about 1.5%. These shares are way undervalued in my opinion and as a bonus, the preferred shares have a high dividend yield.

Alibaba 10 Day Moving Average

I expect Alibaba stock shares to trend higher with a greater 10 day and 50 day moving average for quite some time. Google and Amazon shares will be compared to baba and people are expecting great things.

Apple Trades Higher Today as Alibaba IPO Looms

Apple stock traded about .7% higher today with the Alibaba IPO on the horizon for Friday. Apple was able to bounce back from the drop yesterday.

Rio Tinto 2015 Special Dividend

It is widely perceived that there exists a high change that Rio Tinto will reward shareholders with a special dividend to be announced in February of 2015. With its dividend yield already approaching 4%, this could prove to be a superb reward. I feel that Rio Tinto is under appreciated by the stock market right now and that it will prove to increase in share price soon.

Undervalued Baseball Cards

My Baseball Card Space now sells its own cards, and starting today 8/18/2014, the first card will be listed here. Buy the following Magic Johnson jersey autograph here and it is serial numbered out of only 32 cards. Please feel free to email me with any questions at anthonyparsonscpa@gmail.com. Also, if you would like shipping discounts for purchasing multiple cards, please email me so that I can give you a quote. The Clyde Drexler autographed jersey card along with the David Robinson autograph are great items for you as well. More and more cards are being listed, find a great deal here including a Ken Griffey Jr. Upper Deck game worn jersey card from 2004.

Magic Johnson Autographed Jersey Card 2006-07 UD SP out of only 32

Clyde Drexler 2009-10 Panini Classics jersey autographed card out of only 25 but number 22 (jersey number!!!!!!)

David Robinson 2009-10 Panini Preferred autographed basketball card - Crown Royale serial numbered 09/10. (wow!)

Larry Bird 2010-11 Panini Absolute Icons autographed basketball card - serial numbered 19/25.

Shaq 2003-04 Topps Chrome Chromographs autographed basketball card - only $39.99.

Buy a Ken Griffey Jr. 2004 UD game worn jersey card serial numbered /199 for only $9.99 here.

Buy a 1992 Kayo Boxing gold hologram card of Evander Holyfield and Mike Tyson (MBS 9 mint) here.

Find a great 1999-00 Fleer Mystique Ron Artest serial numbered rookie card (MBS 10 gem mint) here.

Vince Carter Panini Prizm autograph from 2013-14 only $29.99.

The links on here from this point on are other people's cards. A comprehensive baseball card directory can be found on this page. The following are taken from articles from the sites: for instance, Dan Marino will be found under M and Michael Jordan will be found under J. The basketball cards from the 1980's and the rookies it contains are superb long-term investments for card collectors in my opinion and can certainly provide a good gain for getting them at current prices.

A B C D E F G H I J K L M N O P Q R S T U V W X Y Z

The directory will also consist of specific card years for baseball and football. In basketball and hockey, the years contain two years such as 1980/81. To find those, search for the beginning year such as 1980 for 1980/81 Topps.

1980 1981 1982 1983 1984 1985 1986 1987 1988 1997

1989 Score Football 1989 Topps Baseball 1982 Topps Baseball 1983 Topps Baseball

1983 Star Company Star Company Bagged Set 1986-87 Fleer 1993 Bowman

1992 Bowman 1985 Donruss 1981 Topps Baseball 1988 Topps Baseball

1980 Topps 1987 Topps 1985 Topps Baseball vintage card

1951 Bowman 1953 Topps 1951 Bowman Mickey Mantle 1980-81 Topps

Upper Deck Exquisite Basketball 1987-88 Fleer Basketball 1981-82 Topps

These first links are for cards currently for sale by me on the site. Please see the details on each page, so far there are about 6 pages with cards for sale and many of them are available in quantity, and for great prices. The more cards you order at one time, the more the shipping discounts are.

2007 Topps DPP Kevin Kolb Rookie Card 1999 Pacific Dan Marino #5 1995-96 Hoops Kevin Garnett Rookie Card 1984 Topps Don Mattingly Rookie

1991-92 Upper Deck Michael Jordan cards 1991-92 Hoops Michael Jordan Team USA Card Jake Voskuhl Rookie Autograph

2003-04 Upper Deck Rookie Exclusives Lebron James rookie card #1 Topps Finest Brandon Roy rookie card Randall Cunningham Autograph

Fleer Ultra Allen Iverson Rookie Topps Signature Basketball Cards Low Prices Ultimate Collection Basketball Cards

1989 Donruss Rated Rookie card - Ken Griffey Jr. #33 - only $4 Sinorice Moss Letterman Patch Autograph Rookie Roberto Alomar Rated Rookie Just $1

1979-80 Topps Basketball Phil Ford Rookie Only $1 1986 Topps Baseball Ozzie Guillen Rookie Card 1987-88 Fleer Danny Ainge - $1 only awesome deal

The rest of this page is going to highlight everything from the site, including all memberships in social networking sites promoting My Baseball Card Space, and so much more. This site strives to be the most comprehensive sports card list you will ever need. The cards offered for sale are from sellers from all around the world.

Baseball Card Directory - Organized by letter and by year.

Hanley Ramirez Rookie Mickey Mantle Rookie Baseball Card Information Authentic Autographed Memorabilia

Manny Machado Rookie Cards

Vintage baseball cards are a wise choice when purchasing cards because the players have already proven to be great or are already considered to be rare and are valuable. These cards usually tend to hold their value much better than newer cards because the players no longer have to prove themselves in order to maintain their worth. Joining Ebay through the link on this page is also a great idea because you can purchase baseball cards at prices well below book value and find a wide variety of cards that usually cannot be found in one place.

First, the most valuable vintage baseball card in existence other than the original Peck & Snyder card is the 1909 T-206 Honus Wagner tobacco card. The auctions for his card routintely fetch over $50,000, $100,000, and much higher prices depending on condition. For our article on T-206 vintage baseball cards, here is a link to them - t-206 vintage cards

Bowman vintage baseball cards are great and contain the 1951 Bowman Mickey Mantle rookie card and Willie Mays rookie from that year as well. Finding cards like those can be difficult because of the high values for them. If you shop for them on Ebay though, and you also look for commons and lesser stars from those years, you can find that a card maybe with a value of $80 in near mint condition can be found for $30 or $40. Here is a page of our site devoted to sports cards sales

I have collected for many years, here are some of my favorite products.

1989 Score Football 1989 Topps Baseball 1982 Topps Baseball 1983 Topps Baseball 1983 Star Company

Star Company Bagged Set 1986-87 Fleer 1993 Bowman 1992 Bowman 1985 Donruss

1981 Topps Baseball 1988 Topps Baseball 1980 Topps 1987 Topps 1985 Topps Baseball

vintage card 1951 Bowman 1953 Topps 1951 Bowman Mickey Mantle 1980-81 Topps

1981 Topps boxes for sale http://www.mybaseballcardspace.info/1981_Topps_Box

Please join our community free http://www.mybaseballcardspace.info

US Stock Futures Unchanged

As of 4:50 am eastern time, US stock futures for the Dow Jones Industrials and the S&P 500 are unchanged. Traders will look for direction at the open of trading in New York.

Buying Alibaba Stock on Margin

You can buy Alibaba stock on margin through a brokerage account. This is risky however, because in Alibaba shares go down in value, you can be on the hook for steep losses plus interest. I would recommend caution before buying baba on margin.

Apple and China Mobile Shares Under Pressure

Shares of Apple and China Mobile came under pressure yesterday when it was announced that the new iphone6 may be delayed until 2015. This is very short sighted reasoning in my opinion and the stocks resumed an upward climb earlier today. I expect the market to reverse the short decline quickly because their long term strength is in tact.

Australian and Asian Shares Get a Spike

The stock markets in the United States got a boost yesterday, and this is translating to stock market gains this morning overseas. Names like Rio Tinto and Coca Cola Amatil are marching higher. In particular, I continue to think that these two stocks are undervalued. China Mobile and Bank of China also are sharply higher.

Tuesday, September 16, 2014

Alibaba Stock Options Trading

I for see that there will be a lot of stock options trading activity in Alibaba. One of the strike prices for longer term futures that I see as feasible is $140 per share. These would probably be the ones at January 2016 (expiration) that would have this high of a strike price.

Alibaba IPO Buying on Fidelity

Fidelity is one of the brokerage firms that offers participation in the baba IPO. If you want shares at the initial public offering price of $66 to $68 per share, check it out on there and hurry if you need to open a new account.

Buy Shares of Alibaba on Fidelity

If you open a new brokerage account on Fidelity, you can easily buy and sell Alibaba stock shares. It has low commissions on the trades, with them being only $7.95 per share. Open an account today.

Alibaba Shares Volume Leader

I believe that shares of Alibaba on September 19th will be among the most actively traded shares on the stock market. I expect this to continue for some time. With the IPO having overwhelming demand, there should be a lot of shares in circulation.

Alibaba Stock Brokerage Account

Opening up a brokerage account on Fidelity, Schwab, Ameritrade, Share builder, or Scottrade will allow you to buy and sell shares of Alibaba (baba) stock. Consider doing so today through advertising on this site. Also, Yahoo! Finance is a great place for real time stock quotes of Alibaba.

Alibaba After Hours Trading

On September 19th, when baba begins trading, I expect it to make a big impact in after hours trades. I think it will be a volume leader and that it will also lead in price percentage change in the shares of stock.

Will Alibaba be Featured on CNBC Street Signs?

I believe that Alibaba, ticker symbol BABA will be featured on CNBC Street Signs as soon as trading begins on September 19th. I find that Alibaba is going to become a bellwether of the tech industry. With recent weakness in shares of Apple, this is a time where BABA and Google can step up.

Alibaba Set to Open IPO September 19th BABA

It is official. Alibaba will begin trading on September 19th under the ticker symbol BABA. The expected IPO price range has been increased to $66-$68 per share. I wonder what Jim Cramer would have to say about this on Mad Money. I think Alibaba is headed to over $100 per share.

Can New Apple Payment System Rival Paypal?

The question is whether the new payment system from Apple can rival Paypal. In my opinion, yes it can. Ever since Apple computers, I liken it to the rivalry with IBM in which Apple was very competitive.

Apple is Getting Positive Analyst Comments

In regards to the iPhone6 and Apple Smart watch launch, analysts have come out with positive comments about the company. On Yahoo! Finance right now, the latest is that Apple could be entering another cycle of rapid price appreciation.

US Stock Futures Point Toward a Lower Open

US major stock index futures look to be headed lower in the morning as of 6:31 am eastern time. This indication could change, however, by the opening bell.

Monday, September 15, 2014

Rio Tinto and Coca Cola Amatil Trading Higher

This morning in Australia, both Rio Tinto and Coca Cola Amatil are trading a bit higher. I believe these stocks have what it takes to outperform the market over the long term.

Sunday, September 14, 2014

AT&T Shatters One Day iPhone Sales Record

It was announced on Friday that AT&T has broken its one day record for preorders of iPhone. This bodes well for sales of Apple's newest product as ordering appears to be brisk.

Weak Data Out of China Punishes Asian Stocks

Weak Chinese economic data is pushing Asian stocks downward on Monday morning. I believe that this is a short term problem and that many of these stocks remain undervalued.

Thursday, September 11, 2014

Yahoo Shares Look Good for Value

Due to the upcoming Alibaba IPO, Yahoo shares look like a good bargain to buy due to its stake in Alibaba. Investors should see a boost if Alibaba share prices rise.

Stock Screeners

Today, I uncovered three potentially undervalued stocks using a stock screener. These are in the technology sector. As the articles are published on seeking alpha,I will highlight them here.

Net Element Skyrockets

On September 10, 2014, the shares of net element, nete, jumped by over 100% due to a favorable reaction tied to Apple's new payment system.

Lakes Entertainment Reverse Split

Lakes Entertainment, symbol lack, effectively reversed split on September 10, 2014, where the change took effect on its stock price.

Rio Tinto Mostly Unchanged

Rio Tinto is essentially trading flat this morning on the Australian stock market. As we look toward 2015, it is my opinion that Rio will begin trending upward.

China Mobile Trading Higher

As of 4 am eastern time, China Mobile is trading higher by about 1.3% to 100 Hong Kong Dollars per share on the Hang Sent Index. This would indicate that we are looking toward a higher open soon on Wall Street.

Wednesday, September 10, 2014

Should Cincinnati Bell Spin Off Cyrus One Shares?

See and participate in a great discussion on whether or not Cincinnati Bell should spin off its shares of Cyrus One to cbb shareholders. Find the discussion on these stocks here http://seekingalpha.com/article/2473305-cincinnati-bell-offers-good-value-and-opportunities-for-the-future

How to Identify Undervalued Stocks

One way to identify a potentially undervalued stock is to find one trading at a discount relative to its 52 week high. Also, if the pe ratio coupled with its projected 5 year growth rate is favorable, that is a good method as well.

Year End 2014 S&P 500 Rally

I believe that the S&P 500 will see a significant year end rally and run headed toward 2015. I am bullish overall on the stock market at this point. Some of the stocks I like have been highlighted and will continue to be here.

Amazon Stock is at a good level

Shares of Amazon are trading at near $331 per share. This is a healthy discount from its 52 week high of over $400 per share. I view this as a good entry point if you like the stock.

Apple Pay Helps Boost AAPL Price Target

Analysts came out today and raised the price target for Apple shares, to as high as $116 per share. Apple's payment system, Apple Pay, helped propel this. Read the news release here http://finance.yahoo.com/news/apple-payments-may-boost-sales-123320972.html

Rio Tinto and Coca Cola Amatil

My newest article on seeking alpha covers my top two Australian stock picks. These stocks are Rio Tinto and Coca Cola Amatil. The article discusses their merits. Read it here http://seekingalpha.com/article/2484595-my-top-2-australian-stock-market-picks

Vale is Undervalued

In my opinion, the stock price of Vale S.A. is undervalued. I own shares of it. There is a risk that the 2015 dividend will be cut and that there will be continued downward pressure on share prices due to a weak iron ore market. I feel that these risks are overstated by the market.

Nickel Outlook Improves for Vale

It was reported yesterday by Barron's that Vale sees an improved outlook for the metal nickel. This lead to an increase in Vale shares yesterday. The link to the report is here http://blogs.barrons.com/emergingmarketsdaily/2014/09/09/vale-sees-boost-from-nickel-metals/?mod=yahoobarrons&ru=yahoo

Is Alibaba a Buy?

Is Alibaba stock a buy? In a short answer I think so. Some have assigned it a price target of $100 per share and I think it could go to $120. It is not without risk, however.

Alibaba versus Apple Stock

Which stock is better to buy? Alibaba or Apple? In my opinion, Alibaba is one that I feel could double from its IPO offering price. Both companies are good but I think Alibaba is an intriguing play.

Tuesday, September 9, 2014

China Mobile and Bank of China

Here is an article I just wrote recently on why I think China Mobile and Bank of China are two great undervalued stock picks http://seekingalpha.com/article/2482595-two-top-chinese-stocks-for-growth-and-dividend-income

Subscribe to Alibaba IPO

Right now, the Alibaba IPO for shares is heavily oversubscribed. A new subscription attempt to get shares at the IPO indicated price of $60-$66 per share is likely not going to come to fruition. A better move is to either find an alternative investment, or to wait for the shares to trade on the open market. At that point, you can still take advantage if the stock price continues to rise, which I believe it can.

< />

< />

Apple Share Price Action 9/9/2014

The share price action of Apple stock today went as expected. Typically, new release product launches are met with an indifferent attitude by shareholders and investors, and today was more of the same.

The new Apple products' true test will be when sales start coming in, and living up to the lofty expectations is key for the stock price to continue to rise.

The new Apple products' true test will be when sales start coming in, and living up to the lofty expectations is key for the stock price to continue to rise.

Apple iPhone6 and Smart Watch

Apple, today on September 9, 2014, unveiled its new Smart Watch and the iPhone6. Initially, AAPL was up over 3% on the news. Afterwards, by the end of the trading day, shares ended down slightly. The event was ho hum news for investors as it stands today. But as we all know, the story with Apple will continue.

U.S. Stock Futures 9/9/2014

As of 3:07 am eastern time, it is looking like the Dow Jones Industrial Average is indicating a lower opening by about 10 points for later today. Hopefully things change for upward momentum.

Monday, September 8, 2014

Undervalued Dividend Stocks

Undervalued dividend stocks can be found by searching for good sustainable yields. Additionally, a history of dividend increases is good, along with the ability for that to continue. Altria, a stock I am long in, is a good example.

Rio Tinto September 9 2014 Share Price

As of 10:11 pm eastern standard time on the evening of September 8th 2014, the share price of Rio Tinto is currently trading up .28% in Australia at 61.19 per share.

Alibaba Oversubscribed IPO

It is safe to say that the IPO of Alibaba is likely oversubscribed. The lucky participants who get shares at the subscription price should be very happy when Alibaba begins trading, likely on September 18th.

Jim Cramer on Alibaba

When Alibaba starts trading,I fully expect Jim Cramer to come out with some sort of opinion on the stock. This may include a price target, but more likely on Mad Money he will advise as to whether or not he thinks shares are a buy.

Alibaba on CNBC

When trading for Alibaba begins on the stock market, it likely will be featured on CNBC. The opening trades and share price fluctuation should be analyzed in detail.

Alibaba Price Target $120 Per Share

In my opinion, a three month price target for Alibaba shares is $120 per share. I feel that the market will quickly increase its market cap.

Alibaba Opening Bell

At the opening bell, what are your thoughts as to where Alibaba stock will be trading. Does anyone think it will be over $100 per share?

Value in Emerging Markets

I am finding many undervalued stock picks in emerging markets such as in China, and Brazil. Dividend paying stocks here bode well if these markets continue to march higher. The upcoming Brazil presidential election is paramount.

Sunday, September 7, 2014

Ohio Stock Pick

For the area of Ohio, as far as a quality company that is based in Ohi, I think that Cincinnati Bell is a great choice to add to your portfolio. It is in my portfolio and I believe it is undervalued due to its investment in Cyrus One.

Alibaba First Quarterly Earnings Report

Alibaba's first quarterly earnings report as a publically traded company will be closely scrutinized, as will its historical data. Investors will likely determine if its pe ratio is supported when ascertaining the future growth prospects for the company.

Alibaba Market Valuation in Question

Undoubtedly, this week's upcoming IPO of Alibaba will bring a lot of attention and likely a rise in share price. With this, it will create lofty expectations for future results. Can Alibaba live up to the share price hype? Only time will tell, Google did.

Alibaba Expected Market Opening Price

When Alibaba begins trading on the stock exchange this week, I estimate the opening price to be about $80 per share. Of course, this is a guess but that is what I think.

High Yield Dividend Stocks

Right now, I am finding value in some international names when looking for dividend stocks. These are particularly good in my opinion because many are far in price from their all time highs.

3 Solid Stocks Under $6 Per Share in 2013

Today, I would like to discuss three stocks that I found using a stock screener on May 8, 2013 at 10:55 am pacific time. Previously, I had ran this screen at the end of last year and had identified companies that fit this criteria. Those have done well since. This article will attempt to do it again over both the short and long term. As always though, please conduct your own research and due diligence before deciding whether or not in any of these stocks.

The stock screen had the following criteria:

- Component of the NYSE or the NASDAQ.

- Market caps that qualify them as a small cap or larger.

- Share prices between $1 and $6.50.

- Current fiscal year EPS growth of at least 10%.

- PE ratio of 10 or less and/or a PE ratio of below the industry average over the trailing 12 months.

The only thing I changed in the screener this time was that I lowered the high end of the share price to $6.50 from $7 the last time I ran it. One of the stocks found in this screener was Siliconware Precision Industries (SPIL). Since I have already written about that stock very recently as referenced above, I will not repeat the analysis of it here. For those of you following that screen though, please note that this company was found again using this same criteria.

Originally, the screener was only going to go up to $6 in share price. On May 8, 2013, ION Geophysical Corporation went up to over $6 per share after closing at less than that the previous day. In order to still include it, the upper limit of the share price was adjusted after I started writing this article to say up to $6.50 per share. The true results of this screen on May 8th for shares from $1 to $6 in price included ION Geophysical so I wanted to make sure to include it as well.

This stock screen was designed to uncover stocks that are priced low, but that still have solid fundamentals that would give a preliminary indication that they are earning good money and growing. A relatively low PE ratio cannot be achieved without positive earnings, and the growth in earnings may help us find stocks poised for great growth. The low share price makes it easy for someone to get 100 shares for $650 or less.

The stocks we are going to discuss and highlight here that were found in the screener are Amkor Technology, Inc. (AMKR), ION Geophysical Corporation (IO), and MCG Capital Corporation (MCGC). The following is a one year price chart as of today, May 8, 2013, for the three companies. It is expressed as percentage changes.

As the chart shows, the best performing company over the past year has been MCG Capital Corporation. ION Geophysical corporation is up today (May 8, 2013) by 6.77%. The fact that these companies have not performed great as a whole over the past year when compared to the S&P 500 makes me optimistic that we may have identified companies that could outperform over the next year. I am a believer that individual stocks have periods of underperformance and periods of outperformance that is hard to predict, all else being equal.

Amkor Technology provides outsourced semiconductor packaging and test services. Per Yahoo Finance!, the stock is trading today at $4.46 per share and that is right in the middle of its 52 week range. The company beat analyst estimates for its earnings in the last two quarters reported. It is expected that it will earn .57 per share this year, compared to .46 last year. Next year, analysts expect the company to earn .72 per share. Its five year growth rate per year is expected to be 10%. On April 25th, the company surged 9.84% after beating analyst expectations for earnings and revenue. If the company can continue to beat expectations, and deliver on or exceed its forecasted growth, a rise in share prices seems quite likely to me.

ION Geophysical Corporation is the next stock in this article. Today, the company's stock is up 6.56% at the current time. Yesterday it was announced that an insider purchased an additional 196,000 shares at a price of $5.90 to $5.94 on 5/6/2013. This is a huge catalyst for the stock as the purchase price of this, being around $656,000, represents a significant portion of ownership interest for a single insider purchase. The company serves the energy industry. Analysts expect it to earn .44 per share this year, compared with .37 per share last year. Next year, analysts expect the earnings to jump to .60 per share. The company is expected to have a great annual growth rate over the next 5 years of 18% per year. Continued insider purchases and a realization of this healthy growth rate are two large factors that could fuel a rise in share prices for this company.

MCG Capital Corporation is a private equity firm. The company goes ex-dividend as of today (May 8, 2013) and it currently has a huge dividend yield of 9.4%. Over the past year, coupled with its large dividend, the stock has significantly outperformed the S&P 500 and any investor who had it during this time has to be very happy. The fact that it is expected to earn .47 per share this year compared to .25 last year is a large factor that supports this price increase in my opinion. This comes despite the fact that the company has met expectations for earnings precisely the past four quarters. It is pegged for annual growth of 10% over the next five years. Forbes via DividendChannel published an article that highlighted the company as a high dividend payer that, at the time, was selling for less than book value. If the company can maintain and/or increase its dividend and earnings, look for this stock to continue to rise in price.

Thank you for reading this article.

Excellent Dividend Yields in Telecom - Never Overvalued

This article will take a look at four of my favorite names in telecom. More specifically, it will look at which one of these stocks is the best investment at current price levels. Also, it will evaluate some of the opportunities on the horizon out of these names, with a case for the most compelling value in this industry.

The four stocks we will look at today are AT&T (T), Verizon (VZ), Vodafone (VOD), and CenturyLink (CTL). Please note that I wrote this article in 2013, but the dividend strength in these companies hold true today.

These stocks all pay a healthy dividend, and before we look at key metrics to help decide which stock offers the best opportunity for price and value at the moment, I would like to discuss the two stocks that I feel have had the most compelling developments over the past year.

Vodafone is in a great position right now with the news swirling that Verizon would like to buy out its 45% ownership interest in Verizon Wirless, their joint venture. It is possible that the deal could include a cash and stock offer, and the estimated dollar amount of this transaction is around $120 to $130 billion. This, in my opinion, makes Vodafone the most appealing stock out of these four right now if we are only looking at immediate value for spin-offs and corporate changes. As Vodafone is near a 52 week high currently, investors obviously are thrilled with these developments.

If Verizon were to make a cash and stock offer to Vodafone for this stake, it offers Vodafone some opportunities. The thing I worry about for Vodafone is if it is a mostly cash offer, the lucrative venture will no longer add to its earnings. In the event that it is mostly a cash offer, the company will have to be able to reinvest this money into a venture to grow its business, or look to acquire a company to add to earnings and possibly find a new source of growth. If I were Vodafone, I would consider making a move to acquire a large company if most of this deal was made in cash. I believe that a purchase of Directv (DTV), for example, could be a great fit.

To discuss the possible benefits of Vodafone exploring a buyout of Directv, let us look at a few things. Centurylink beat earnings estimates recently and reported great growth in its PrismTV cable subscription base. Based on this and based on seeing commercials and using PrismTV first hand, CenturyLink has done well venturing here. I believe, for Vodafone, that a purchase of Directv would be a great strategic fit. It would give the company the equivalent of what PrismTV is to CenturyLink, but on a much larger scale. I liken it to Altria's (MO) stake in SABMiller brewing company, as even though the companies are not in the exact same industry, they are a close fit. Altria has seen great results so far from its ownership stake in SABMiller. The benefits to such a merger include overlapping subscribers and bundling service, while also being able to reach out to a larger customer base. Directv is a $36.71 billion company based on its current market cap, while Vodafone currently has a $147.49 billion market cap. I would view such an acquisition as being a bold move, and a move the company should only consider if it wants to take an aggressive move toward growth. A large cash infusion from its stake in Verizon Wireless could certainly make it more feasible from a cash standpoint. Furthermore, the antitrust obstacles that AT&T encountered with its proposed acquisition of TMobile may not come into play if Vodafone tried to acquire Directv and if Directv is successful in its bid to acquire Sprint (S). Vodafone's primary telephone market is in Europe and if it no longer is involved in Verizon Wireless, this could provide it with an entry to the U.S. market and add further value to the company.

Furthermore, I would like to look at some metrics to evaluate when deciding where I would put new money at this point with these companies. I am already long all four companies, but if I were to put new money in right now, I would be selective as to where. Dividends are a compelling factor for me as far as this industry goes, so let's take a look at where these stand.

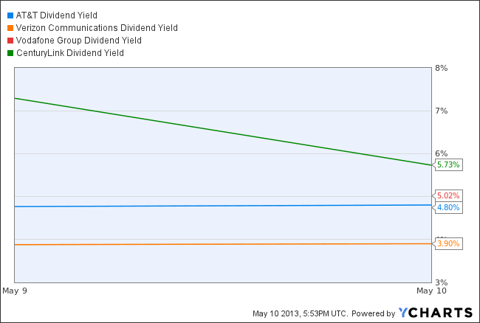

T Dividend Yield data by YCharts

CenturyLink has the highest current dividend yield. CenturyLink, however, cut its dividend earlier this year. I believe the market reaction to that was way overdone, as did many other people, as it sank by over 20% the day that was announced. Since then, the price has recovered. I believe it was overdone especially because the company planned to buy back stock and pay down debt instead of maintaining the previous dividend, which is value added to the company. The other stocks above have solid dividends, with long histories of increases. The recent stock price increases that the companies have experienced have lowered the yields, and a couple of years ago I would have wanted a 6% dividend yield. Now, 5% is the best we can hope for while the long-term bonds of these companies can net you a slightly higher yield.

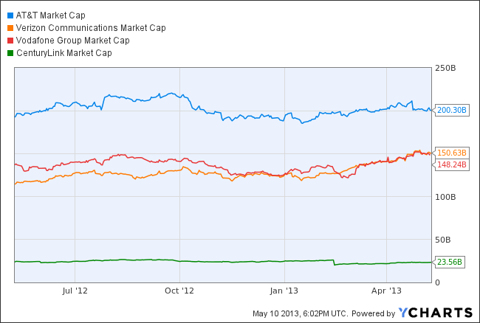

The following chart will look at the market cap for each company.

T Market Cap data by YCharts

AT&T has the highest market capitalization of this group. Verizon and Vodafone are a close second and third, with CenturyLink far behind. I think market cap is important because it can help a company withstand a prolonged downturn, as evidenced by the companies getting through the financial crisis in 2008 without having to cut their dividends.

Based on these factors and qualitative considerations, I have the following opinions on these stocks. AT&T and Verizon are solid companies with a long history of dividend increases and value added spin-offs for shareholders. In the near term, I do not see anything out of the ordinary coming from these companies. With CenturyLink, its acquisition of Savvis and its PrismTV are two exciting developments and growth opportunities. I view PrismTV as something that could be spun off in the future, but I think that will take many years to materialize into something worth a few billion dollars. In the near term for new money, I would say that Vodafone is the way to go. It pays a strong dividend and there is the possibility that shareholders could get shares of Verizon if a buyout of Verizon Wireless comes through. The exciting potential that Vodafone has from its potential divestiture in Verizon Wireless motivates me to add to my position here if I were going to do anything. I hold all of these stocks in my portfolio and think that they are all great long-term investments. Please conduct your own research and due diligence before deciding to invest in any of these stocks.

Dividend Reinvesting in Undervalued Stocks

If you reinvest dividends in a drip, the best time to do so is when the stock is undervalued, in your opinion, by the current market. Doing so allows you to buy shares at a good entry point, with long term gains possible. It is much better to buy a quality stock near its 52 week low if you feel it will go back to the high point.

Saturday, September 6, 2014

2013 Dividend Stocks - Looking Toward 2015

In20013 on seeking alpha I took a look at my top dividend picks for the year and for 2015 there will be a new installment to find the best ones for investors. Read the article for 2013 here http://seekingalpha.com/article/1063401-5-great-dividend-paying-stocks-for-2013

Petrobras Earnings

Petrobras' third quarter 2014 earnings will be highly watched because its third quarter 2013 earnings came in well below analyst estimates. If the company can manage to at least meet expectations, it is poised to have growth in earnings in the full calendar year of 2014 compared to 2013. For dividend investors this would be good news because that should mean that we will see an increased dividend in 2015 if that happens. I am long shares of Petrobras and am waiting to see these earnings but I am optimistic that they will be great because of all of the developments the company is enjoying.

Alibaba IPO to be a Great One

The upcoming initial public offering for Alibaba is highly anticipated and should bring a share price increase from its IPO price range of $60-$66 in my opinion. Those lucky subscribers who get the shares in the initial price range will be very happy with their holdings soon if the stock price goes up, and I believe it will. This is one of the more important IPOs in recent history, and Alibaba has a large stake of it held by Yahoo!. No one knows yet whether or not Yahoo! will sell its shares of Alibaba or if it will spin it off to shareholders, but this is an IPO that I definitely will be watching.

Mcig Shares are Underpriced in the Current Market

Stock prices of mCig (MCIG) are underpriced in the stock market right now in my opinion. With the upcoming spin off of VitaCig, along with the fact that the company is making a profit in addition to having growing sales, I believe this stock is poised to have a great run soon. If marijuana is legalized, the vape pens that they offer will be used on a much larger scale in my opinion. This is due to the fact that they differ from traditional e-cigs because you can put anything that you want in them. Mcig stock has not done great this year, however last year after the elections there was a run up in price and if all goes well with pot heading toward widepsread legalization, the stock could have its best run yet. Long-term, I also think that mCig is a great value for shareholders. Full disclosure, I am long on the shares.

Subscribe to:

Posts (Atom)